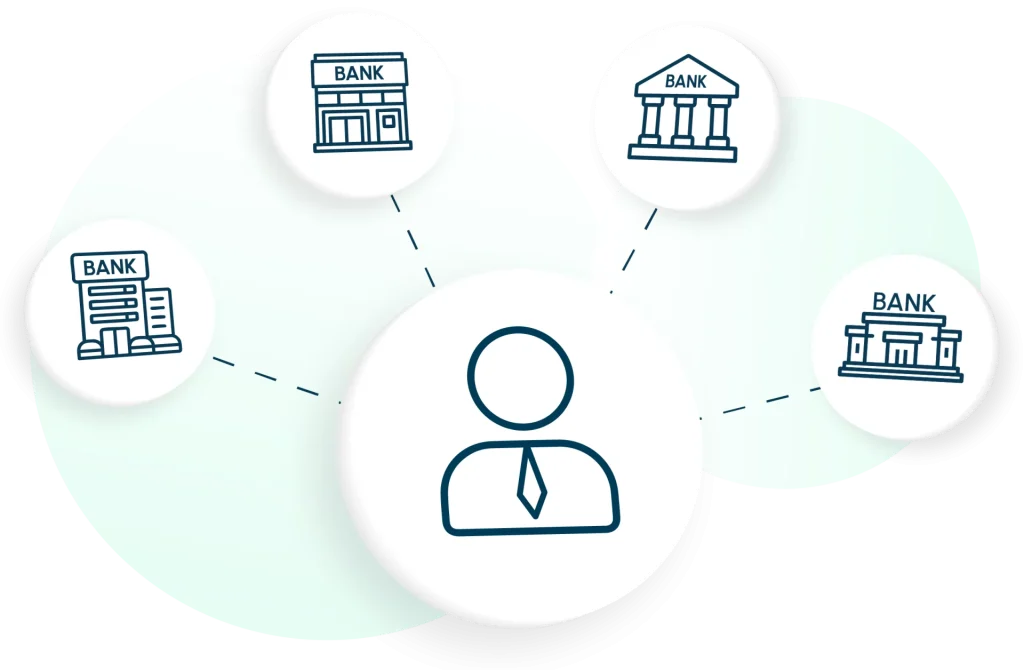

A single integration for multiple banks to offer instalments up to 24 months for ultimate freedom.

With an easy setup, one-time activation and flexible tenure options, your customers won’t have to worry about paying a lump sum once you offer this instalment payment option to them.

As featured on:

Offer seamless integration with multiple major banks in Malaysia, ensuring smooth and fast implementation. With just one quick setup, you can connect to a wide payment network.

Our activation process uses only a single Merchant ID (MID) for all instalment payment options. This one-time setup streamlines the onboarding experience without the need for multiple MIDs.

Offer your customers flexible payment options to enhance their purchasing power without budget concerns, all with fair and transparent transaction rates for you and your customers.

Allowing customers to split payments for larger purchases means they would buy more at once, increasing your bottom line.

Worry less about abandoned carts as smaller instalment payments mean higher purchasing power!

Giving your customers the flexibility to pay with 0% interest on their purchase empowers them with the freedom to make payments on their own terms.

Integrate with multiple banks with just one Merchant ID (MID). Enjoy a hassle-free experience and offer a selection of banks to suit your customers’ needs.

Offer the option to split large payments to 3, 6, 12, or 24 months to your customers so they won’t abandon their carts anymore.

Our IPP is integrated with popular banks including AmBank, OCBC Bank, and UOB, with more to come. Rest easy knowing your customers are getting the greatest payment flexibility.

Our partner banks:

You can choose to sign up with our Advance or custom Enterprise package now and activate IPP together.

Contact our support team to activate IPP for your business now.